Issue 100 | Economic Impact of the Pool and Spa Industry

Share This Post

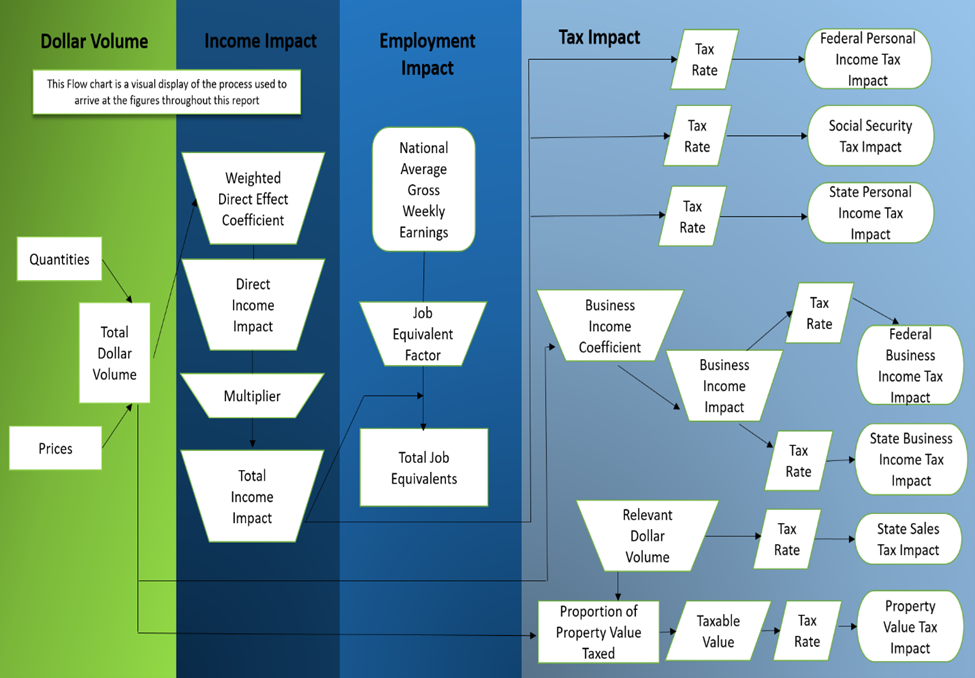

The overall economic impact of any industry reaches far beyond the direct revenue collected from the sales of products or delivery of services. To gauge the full financial impact, it is also essential to consider the employment opportunities generated, the cascading effect of income earned and spent, and the impact and generation of taxes at different stages of each transaction.

An economic impact study is a method to determine the resulting increase in output produced, income earned, taxes generated, and jobs created or sustained.

The following flow chart broadly represents the procedures to determine the total economic impact:

Pkdata conducts economic impact analyses to assist local and national organizations and jurisdictions in identifying and demonstrating the far-reaching impact of the pool and spa industry. Demonstrating the magnitude of the industry beyond direct sales helps identify:

- The significance of an industry to the local economy

- The number of jobs that could be affected by a change in the industry

- The expected impact of legislative amendments or regulations that could affect the amount of money that flows from the industry to the local economy.

Case Study – Impact of the Pool & Hot Tub Industry in Arkansas, 2022

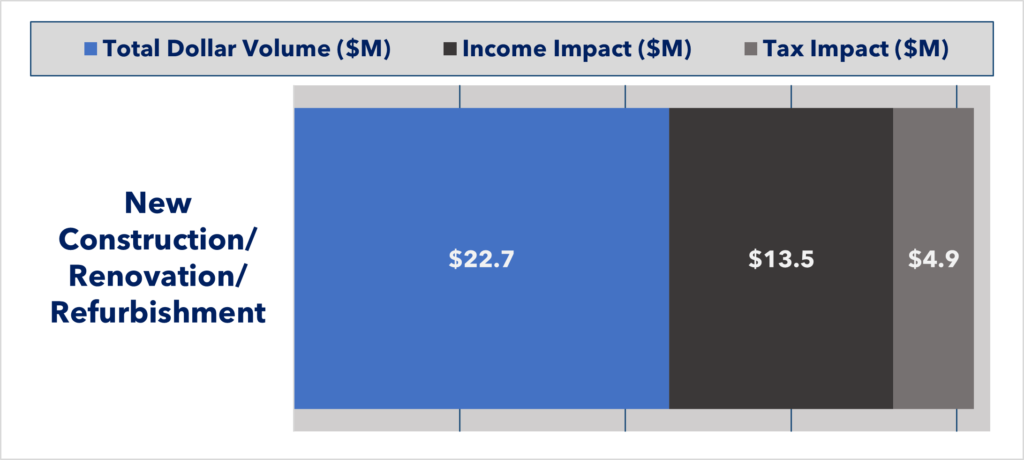

New Construction and Repair/Renovation

For a smaller analysis, we present data for the state of Arkansas to demonstrate the impact of the pool and spa industry in 2022. More than one hundred new residential and approximately twenty-five commercial inground pools were constructed, resulting in direct sales of more than $22M; however, there also was an income impact of almost $14M and a tax impact of about $5 million.

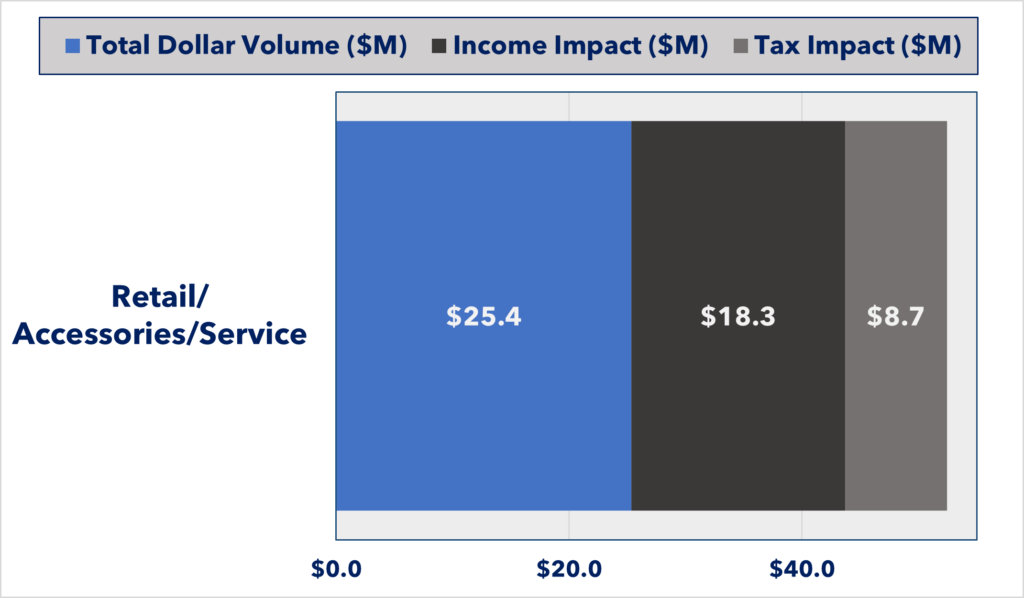

Retail/Accessory/Service Market

The retail/accessory/service market includes new purchases of aboveground pools and hot tubs and the related equipment and chemicals purchased for all pool and hot tub units. The third component is the element of maintenance and/or recurring pool/hot tub service.

During 2022, more than one thousand aboveground pools and two hundred hot tubs were sold in addition to service and maintenance for pools and hot tubs and sales of associated chemicals and equipment to total more than $25M in direct sales; however, there also was an income impact of more than $18M and a tax impact of almost $9 million.

For both segments of the industry, the income impact reflects:

- Direct effects – labor costs associated with the construction, installation, and repair of pools and spas

- Indirect effects – the income from the industry’s demand for intermediate goods and services (e.g., the gas station receiving payment from the pool distributor’s truck filling up during delivery).

- Induced effects – represent income from the consumption of goods and services by individuals directly or indirectly employed in the industry (e.g., a pool builder spending money on pest treatment for his home).

The tax impact reflects taxes at each level:

- Federal Personal Income Tax

- Federal Business Income Tax

- Payroll Taxes

- State Business Income Tax

- State Sales Tax

- Local Property Tax

Estimated Total Pool and Hot Tub Industry Impact in Arkansas

Combining the impacts from the construction and renovation of inground pools with the retail segment, which includes sales of aboveground pools and hot tubs, associated equipment and chemicals, and pool and hot tub service and maintenance generates a total impact of more than $94M resulting from $48M of direct revenue, an income impact of almost $32M and tax impact of almost $14M.

Please reach out if you’d like more information on the impact of the pool and hot tub industry in your area. We have all the data you need to make impactful decisions regarding your business.

Sign up for Pkdata report alerts and be the first to know when the latest Pool & Spa market report is released.

Thank you!

You have successfully joined our subscriber list.