Issue 95 | Labor Issues in the Canadian Pool Industry

Share This Post

Like the U.S., the Canadian pool industry experienced unexpectedly significant demand for new pools stemming from the impact of COVID during 2020 and 2021. However, the combination of the increased demand and the effects of the pandemic created problems for pool builders to access the necessary equipment, materials, and labor.

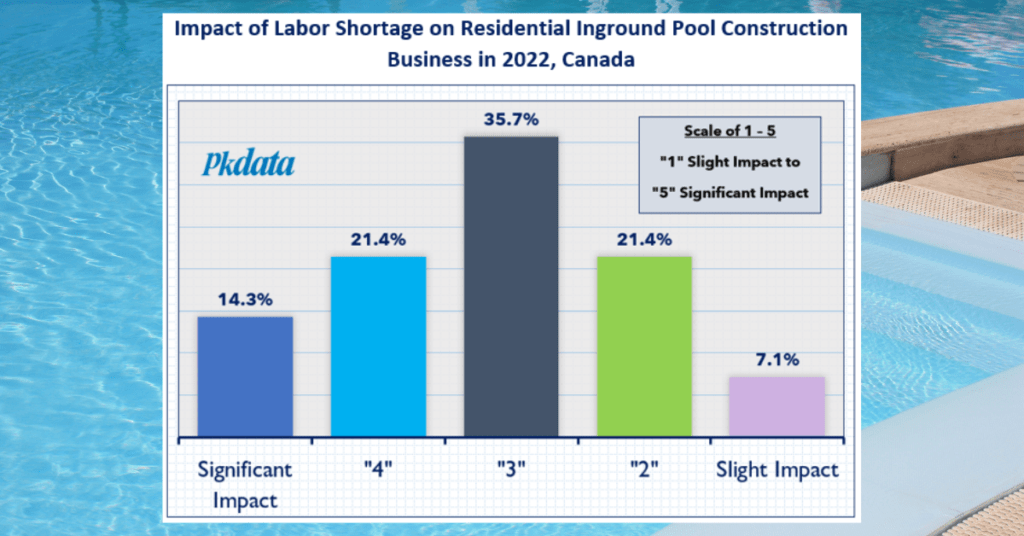

While issues obtaining equipment and materials have become less problematic, in our most recent research with Canadian pool builders, many noted the ongoing labor shortage in Canada as the biggest obstacle to their business in 2022.

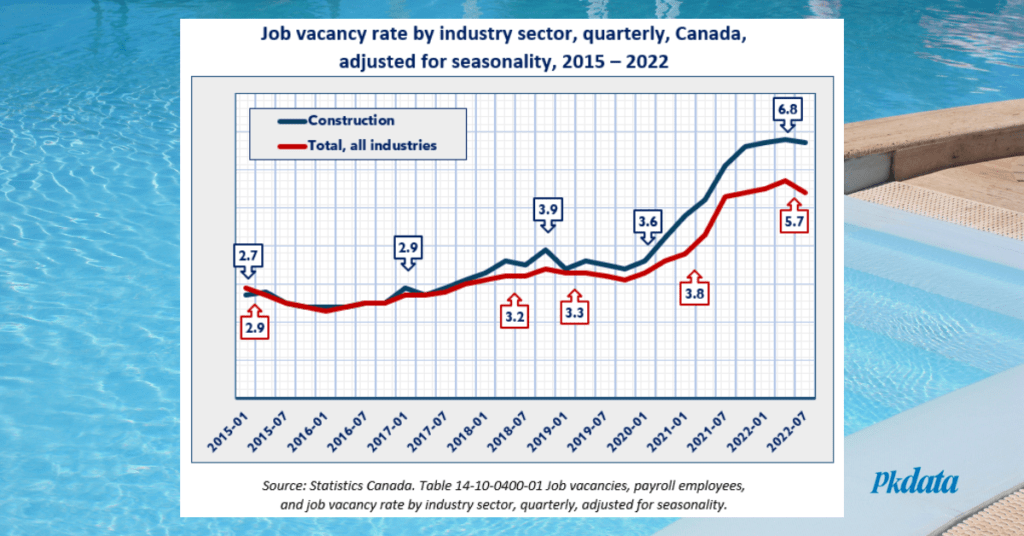

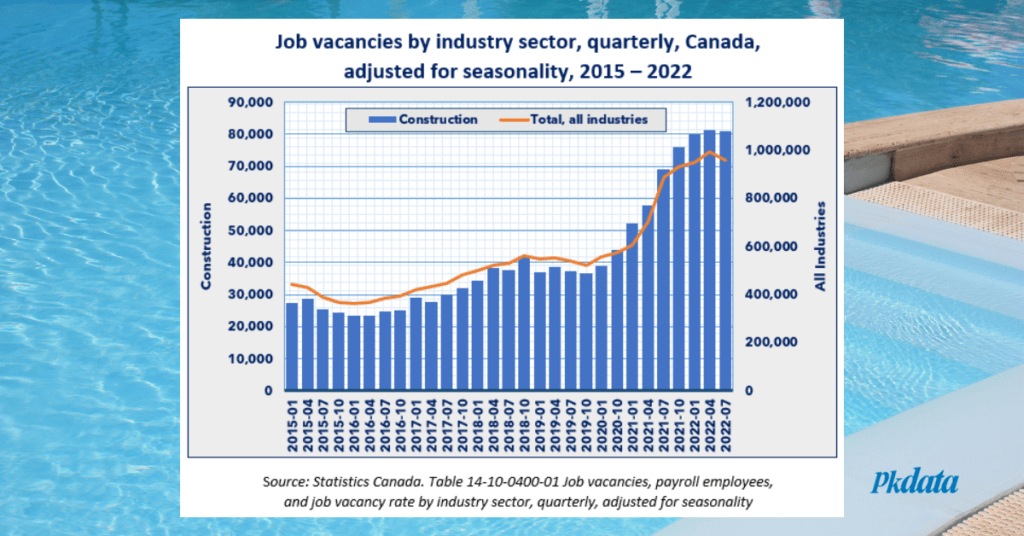

The job vacancy rate (the number of job vacancies expressed as a percentage of labor demand) more than doubled for the construction industry in Canada from 2015 to 2022. Recent information from Statistics Canada showed that Canada’s unemployment-to-job vacancy ratio is historically low amid a record-tight labor market, and from an industry perspective, the construction sector (48.5%) was the most likely to expect the obstacle of recruiting skilled employees.

The shortage of employees in the pool building segment has caused builder frustration, increased project costs, delayed projects, and even caused some builders to turn away work. Forces in the market again challenge Canadian pool builders – with many now tasked with developing innovative recruiting, training, and retention strategies to find and retain necessary employees.

Pkdata’s latest comprehensive research and analysis on the Canadian residential pool industry was just released. The report provides detailed data on inground and aboveground pool sales, the installed base, aftermarket values of associated chemicals, equipment, and service, and the remodeling/renovation segment during 2021 and 2022. In addition, we’ve included detailed analysis of pool builder and owner surveys on all aspects of pool building and ownership.

Sign up for Pkdata report alerts and be the first to know when the latest Pool & Spa market report is released.

Thank you!

You have successfully joined our subscriber list.